Gas market update - Asian competition drives the rise in European gas prices

European gas prices have been trending upwards since mid-February. The upward trend is being driven by a rise in Asian demand, unplanned maintenance in Norway and the US, geopolitical tensions, and signs of recovery of European industrial demand. Storage levels remain higher than average. However, the speed of building up storage remains under scrutiny. The looks set to stay tight in the coming summer months and the year ahead contract is expected to average around 35 EUR/MWh in Q2.

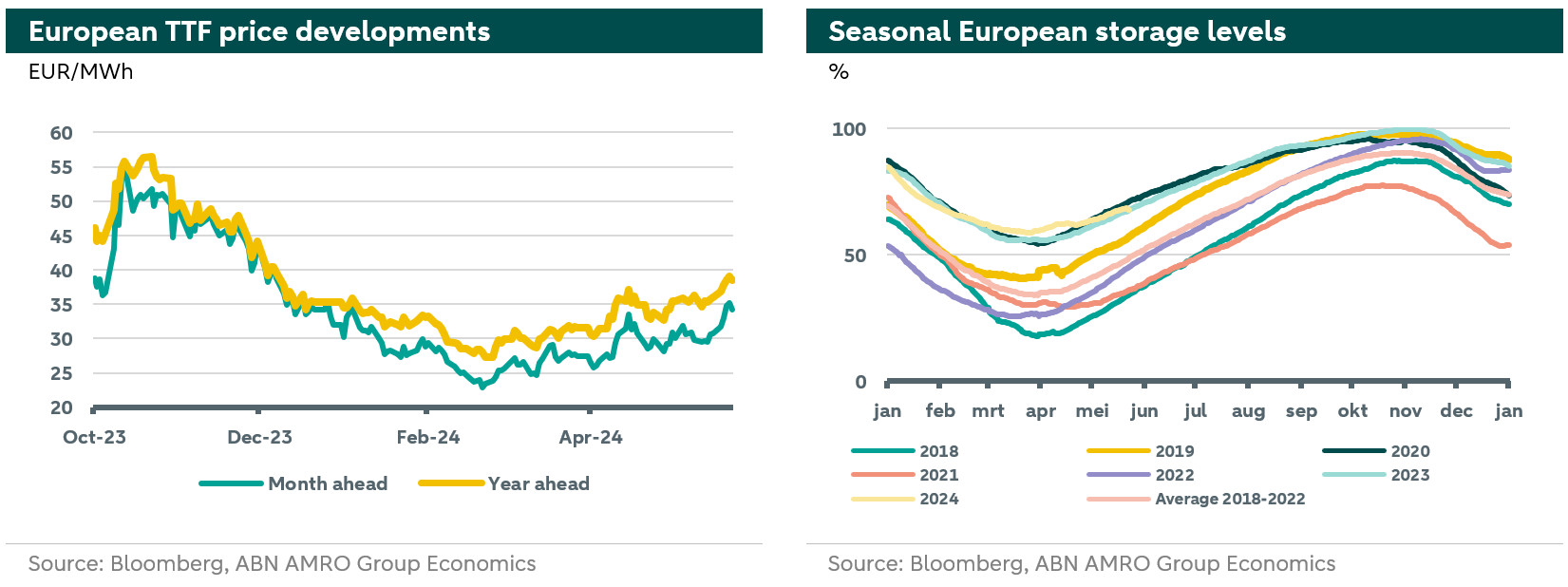

European gas prices have reversed the downward trend that had been in place since mid-October. The European month ahead TTF price averaged 28.5 EUR/MWh since the start of 2024, reaching a low of 22.9 EUR/MWh (27.5 EUR/MWh for the year ahead contract) in February. Since then, we have seen an upward (but volatile) trend. The upward trend was fueled by a combination of supply and demand factors, such as a rise in Asian demand, unplanned maintenance in Norway and the US, along with geopolitical risks that keep the market vigilant. All these factors created doubts among market participants about Europe’s ability to fill its storage before the next heating season arrives, even with the current, higher than average, storage level for this time of the year.

The mild winter in the last two years was one of the key factors that helped Europe to manage the energy crisis and allowed TTF prices to fall back down. However, weather forecasters are predicting that next Winter will be colder, which increases the importance that storage is filled on time. Currently, storage levels remain higher than average (around 70% at the time of writing) as illustrated in the chart above (right). However, the speed of building storage is under scrutiny as market forces are increasing market tightness.

The ongoing upward trend in gas prices is being driven mainly by supply forces, following an increased competition from South and Southeast Asia, which was partly spurred by lower prices, heat waves, and lower domestic gas production. Outages and unplanned maintenance and consequent extension in Norway and the US also put upward pressure on European gas. At the same time , the market remained responsive to any geopolitical tensions such as Red Sea attacks, fears of escalation between Iran and Israel, and strikes on energy infrastructure in Russia and storage facilities in Ukraine. Furthermore, European industrial demand has been showing some signs of recovery with the eurozone composite PMI for May rising into expansionary territory (at 52.3, up from 51.7 in April) with the rise mainly riven by the manufacturing PMI (see more here). All these factors, in different magnitudes, contributed to the upward pressure on prices.

Looking forward, the summer period envisions low gas demand (for heating purposes), however, supply disruptions and heatwaves may take their toll on prices. At the same time, lower renewable output (slower wind) could increase gas demand for power generation. Furthermore, later in the year, attention will be directed to the expected resurgence of industrial demand following the expected cuts in interest rates, while the increase in Asian demand is expected to dominate any increase in additional in capacity for this year, which means that the market remains tight in the upcoming summer months.

Outlook

Based on the above developments, our outlook for TTF year ahead price is to average around 35 EUR/MWh (30 EUR/MWh for the month ahead price) in Q2 of 2024. As industrial demand ramp ups in the second half of the year, the year ahead price is expected to reach 40 EUR/MWh by year end.