ABN AMRO Bank posts net profit of EUR 619 million in Q1 2025

- Investor Relations

Jarco de Swart

Sr Press Officer Corporate Affairs, Finance, Legal and Sustainability

ABN AMRO Bank posts net profit of EUR 619 million in Q1 2025

Key messages

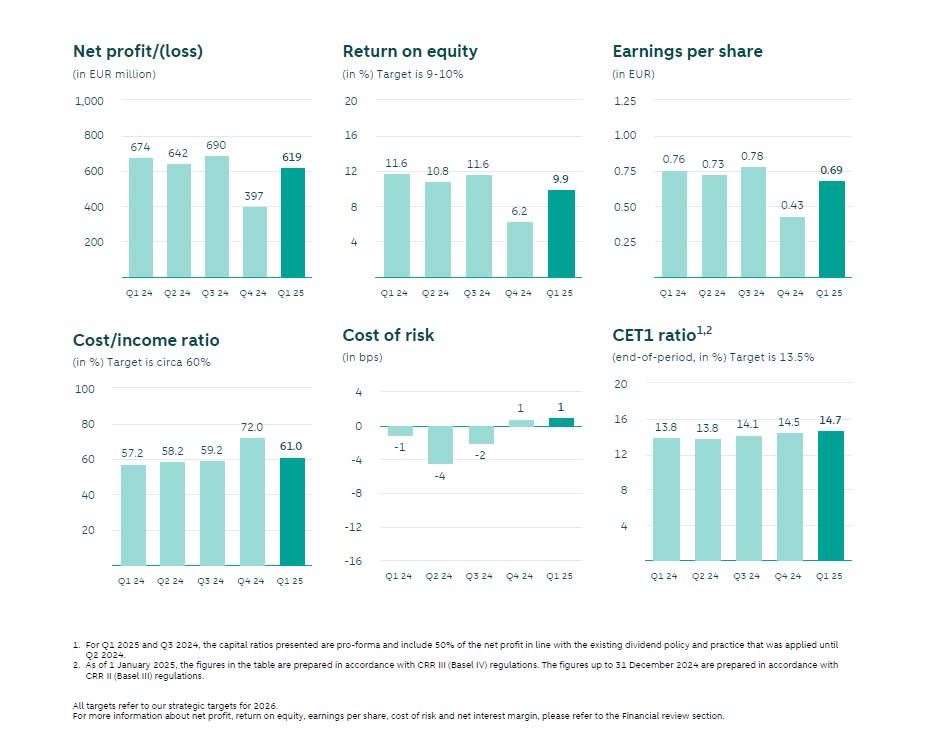

Solid results: Net profit of EUR 619 million, with a return on equity of around 10%

Good business momentum: Mortgage portfolio grew by EUR 1.7 billion and corporate loans by EUR 0.9 billion

Resilient net interest income despite impact from lower short-term interest rates

Continued fee growth: Increase of 8% compared to Q1 2024, with contributions from all client units

Cost discipline: Underlying costs declined 5% compared to Q4 2024; guidance for full-year 2025 unchanged

Solid credit quality: Impairments of EUR 5 million, reflecting net additions for individual files offset by model-related releases

Strong capital position: Basel IV CET1 ratio of 14.7%

Capital Markets Day to be held in November

Marguerite Bérard, CEO:

“As we reflect on the first quarter of 2025, I am honoured to address you as the new CEO of ABN AMRO. I value the trust placed in me by the Supervisory Board to lead our bank in the years to come. In the coming period, my priority will be to lead a strategic review of our activities, while building upon our solid foundations and strong market positions. We will focus on enhancing our profitability, optimising our capital position, right-sizing our cost base and achieving meaningful growth. The outcome of this review will be presented at a Capital Markets Day in November this year.

The Dutch economy continues to demonstrate resilience, with GDP growth in recent years above the Eurozone average, low unemployment and good housing market performance. Thanks to this robust foundation, the economy is well-positioned to navigate the current uncertainties around trade tensions and geopolitical developments. In these challenging times, ABN AMRO performed well, delivering another quarter of solid results and growth in our loan books. This reflects our strategic focus on key growth areas, our credit quality and our ability to adapt to changing market conditions.

In the first quarter of 2025, we showed solid results with a net profit of EUR 619 million and a return on equity of around 10%. This performance was underpinned by resilient net interest income, continued high fee income and limited net impairments. After a few quarters of rising costs, we managed to reduce our underlying costs in Q1 compared to the previous quarter. To deliver on our guidance of keeping underlying costs broadly flat compared to last year, cost discipline remains a priority. Therefore, we enforced increased controls on consultant expenditures and external hiring.

Though challenging for colleagues, as we all need to adjust, it will help us reassess capacity needs and optimise our resources. By collaborating and using our creativity and talents, I believe we can deliver on our strategic ambitions while becoming a more agile organisation.

Our strong capital position, with a Basel IV CET1 ratio of 14.7%, allows us to continue investing in our strategic priorities while maintaining financial stability. In Q1, we submitted the final application to move models to less sophisticated approaches which is now reflected in our capital ratios. The simplification will bring stability and predictability to our capital position. The largest part of our balance sheet remains under advanced models, specifically mortgages, banks and financial institutions. Portfolios that required significant modelling and data efforts will be moved to the standardised approach.

Our continued efforts to improve customer experience resulted in an increase in our Net Promoter Score for Personal & Business Banking during the first quarter of 2025. Clients especially praise our efficient and good customer services, proactive contact, and the convenience of our digital services. This was also recognised by the 2024 Digital Leaders Study, which ranked ABN AMRO among the top performers. Tikkie, with 10 million active users, is a good example of our innovative offering. During King’s Day this year, Tikkie processed a record number of almost 700,000 transactions. We also introduced the Index Mandate, an actively-managed product that invests in underlying passive instruments. With this product we aim to attract younger clients and help them begin with portfolio management.

We remain dedicated to sustainability. In the first quarter we launched the free online Green Building Tool which helps provide commercial real estate clients with insights into opportunities to save energy and improve their energy label. We realise that making the switch to a sustainable society is not always straightforward for our clients. A survey among over 350 business clients at our decarbonisation conference revealed challenges in the energy transition, including high capital expenditure, complexity and cost impacts. We aim to support our clients towards a low-carbon future by providing financing and expertise. One example of how we can help them is our recent agreement with the EIB Group to support Dutch SMEs with favourable financing conditions. This collaboration will enhance economic growth and the sustainability efforts of our clients. It includes the largest risk-sharing agreement with the EIB Group to date, totalling EUR 1 billion.

ABN AMRO believes that everyday represents a new beginning for our customers, and for whom we stand ready to support. I am looking forward to my 'new beginning', collaborating with all my colleagues to deliver results for our stakeholders in the years to come.